1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

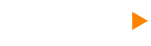

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2023 1st Florida Lending Corp. - All rights reserved

Acquiring the professional services

of a Realtor is very important when

Buying or Selling a home. At 1st

Florida Lending Corp, we view our

work with Realtors as a top priority.

A good Realtor can make the

mortgage process move faster and

with more efficiency as we make

every effort to help Realtor’s

succeed. Click here to learn more

about why it is important to hire a

Realtor

REALTORS MAKE

THE LOAN PROCESS

MORE EFFICIENT

TURNED DOWN BY A LENDER? CALL US!

USDA is for financing qualifying

properties in rural areas. USDA loans

offer low interest s and 100% financing.

Never assume that you wont qualify.

Contact our certified USDA loan officers

who will quickly identify your needs,

and offer you the type of expert advice

you deserve

Our Jumbo land Super Jumbo loans

are ideal for home buyers looking for

higher priced luxury homes. These

loans are designed to simplify home

buying in pricey markets by covering

the full cost of the loan, so there is no

need for borrowers to drain their cash

reserves.

There are 3 types of refinancing (rate-

and-term, cash-out, and cash-in)

depending on your individual needs.

The most popular refinancing is rate-

and-term to take advantage of lower

rates or cash-out to consolidate, pay

down or pay off debt and/or

shortening their loan term, or a

combination of the above.

A vacant land loan is a specialized type

of loan used to finance the purchase

of undeveloped land or a vacant lot.

Unlike a mortgage loan, which is

intended for buying a home, a land

loan is specifically designed for

acquiring raw land. CLICK HERE TO

LEARN KEY POINTS OF VACANT LAND

LOANS:

We offer a full range of Commercial

Real Estate and Investment Property

loans for most property types at very

competitive rates with just the right

terms with fast closing timelines to pay

off an over-due note or to complete a

purchase with a fast approaching

deadline!

A Reverse Mortgage loan for

homeowners over the age of 62 that

can access a portion of the home’s

equity and uses the home as collateral.

The loan generally does not have to be

repaid until the last surviving

homeowner permanently moves out

of the property or passes away.

Bridge Loans are great for Fix and

Flips, Replacing Loan Denials or if you

need quick cash There are no income

or employment verification needed to

qualify. Only an appraisal and source

of funds to close with some reserves.

This program does not require a credit

score or investor experience

Our VA Loan as many advantages that

make it one of the most appealing

paths to home ownership and this great

benefit is reserved exclusively to those

who bravely served our country and

select military spouses. When

combined, these benefits allow

substantial cost savings.

VACANT LAND LOANS

Anyone can purchase, refinance or

cash-out refinance your Investment

property with No Income or

Employment Verification. You can

qualify based on current rental

income or if there is no rental

income. We can qualify you based

on the Appraisers estimated rental

income.

1 YEAR BRIDGE LOAN / NO PREPAY

Which No Doc Funding

Program Meets Your Criteria?

SELF-EMPLOYED

STATED MORTGAGE

ASSET MORTGAGE

90% LTV PRIMARY PURCHASE

12 MONTHS BANK DEPOSITS

NO TAX RETURNS REQUIRED

NO MORTGAGE INSURANCE

600 FICO FOR SOME PROGRAMS

MULTIPLE ACCOUNTS PERMITTED

LOW RATES BUY DOWN OPTIONS

CO-BORROWERS CAN USE

ALTERNATIVE INCOME LIKE W2,

SOCIAL SECURITY AND RENTAL

80% LTV PRIMARY PURCHASE

NO INCOME VERIFICATION

NO EMPLOYMENT VERIFICATION

NO DEBT TO INCOME RATIOS

NO TAX RETURNS

MIN 640 FICO SCORE

PRIMARY OR SECOND HOMES ONLY

NO INVESTMENT PROPERTIES

30 YR FIXED AND 1/6 ARM TERMS

SELLER CREDIT UP TO 6%

80% LTV PRIMARY PURCHASE

NO INCOME VERIFICATION

NO EMPLOYMENT VERIFICATION

NO TAX RETURNS

MIN 640 FICO SCORE

YOUR ASSETS ARE UTILIZED TO

ESTABLISH A MONTHLY INCOME TO

PURCHASES OR REFINANCE YOUR

PRIMARY HOME, SECOND HOME OR

INVESTMENT PROPERTY

VOE MORTGAGE

FOREIGN NATIONAL

ITIN & DACA LOANS

85% LTV PRIMARY PURCHASE

NO TAX RETURNS REQUIRED

NO W2'S REQUIRED

NO PAY STUBS REQUIRED

CREDIT SCORE AS LOW AS 620

UP TO 85% LTV PRIMARY PURCHASE

$150,000 UP TO $5 MILLION

100% USE OF GIFT FUNDS

VERIFICATION OF 2 YEARS

EMPLOYMENT

75% LTV PRIMARY PURCHASE

$200K UP TO $4 MILLION

RATES START IN THE HIGH 4'S

75% LTV PURCHASES

65% LTV REFINANCING

VACATION OR RENTAL PROPERTY OK

30 YEAR FIXED AND 7/1 ARM TERMS

NO INCOME VERIFICATION OPTION

NO CREDIT SCORE OPTION

NO RESERVES IN MOST LOANS

90% LTV PRIMARY PURCHASE

W2 OR SELF-EMPLOYED INCOME

90% LTV w/ 740 ++ CREDIT

85% LTV w/ MIN 700 CREDIT

80% LTV w/ 660 TO 719 CREDIT

75% LTV IF NO CREDIT

NEW PURCHASES AND REFI’S

NO PRE-PAYMENT PENALTIES

NO MORTGAGE INSURANCE

PRIMARY / SECOND HOMES ONLY

407-300-2558

Below is a list of different types

of No Doc and Low Doc Funding

Mortgage program options for

various types of properties.

These options can be helpful for borrow-

ers who may not have the traditional docu-

mentation required for mortgage approval.

However, it's important to note that the

availability and terms of these loans can

vary depending on which program meets

your criteria, and market conditions.

1. No Doc Investment Loans:

2. Low Doc DSCR Investment Loans:

3. No Doc Commercial Property Loans:

4. No Doc (Hard Money) Loans:

5. No Doc Fix and Flip Bridge Loans:

6. No Doc Rehab Bridge Loans:

7. No Doc Stated Mortgage Funding:

8. Low Doc Asset Depletion Loans:

9. Self-Employed Stated Income Loans:

10. Self-Employed Stated Income

HELOC/Second Mortgage

NO DOC FUNDING

- FHA LOANS - NO DOWN PAYMENT

- BANK STATEMENT LOAN - 90% LTV

- 99% LTV CONVENTION HOME LOAN

- SECOND MORTGAGE OPTIONS

- JUMBO LOANS - 95% LTV

- INVESTMENT PROPERTY LOAN - 85%LTV

- STATED INCOME HOME LOANS

- FOREIGN NATIONAL LOANS

- ASSET BASED MORTGAGE LOAN

- FIX AND FLIP BRIDGE LOANS

- NO DOC FUNDING - 6 PROGRAMS

- COMMERCIAL PROPERTY LOANS

- VA HOME LOANS

- USDA HOME LOANS

- ABOUT US

- RESOURCES

- CONSTRUCTION LOANS

- ITIN AND DACA LOANS

- WAS YOUR LOAN DENIED?

- CONTACT US