1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

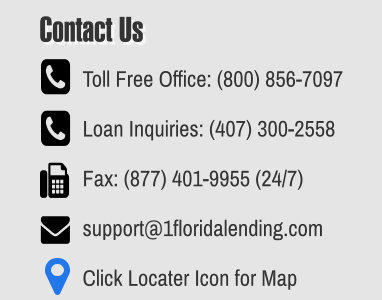

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County

Florida’s Top Rated Mortgage Lender

WE ARE DIRECT LENDERS - NOT RETAIL BROKERS

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County

What is a Self Employed Heloc Second

Mortgage?

Homeowners can access cash from their

home equity without touching the existing

1st Mortgage at the low rate. We qualify

you by calculating 12 or 24 months of

your personal or business bank statements

to show proof of income. Tax returns are

not required!

How much can I Borrow on a Self

Employed Heloc Second Mortgage?

The amount you can borrow with a second

mortgage depends on the remaining

equity value of your home, minus the 1st

mortgage you owe. The amount of the

second mortgage can vary, but between

65%-100% of the equity is a good starting

point.

Benefits of a Self Employed Heloc Second

Mortgage?

Borrowers can use a second mortgages to

finance large purchases such as a new

vehicle, second home, down payment of an

rental income investment property,

consolidate debt, pay for their child’s

college education, renovate their home or

who just need cash.

How do I qualify for a Self Employed

Heloc Second Mortgage?

To qualify, your income is calculated by

adding up all the deposits in your business

and/or personal account for either a 12 or

24-month period, and then dividing the

total by the same number of months. This

method is very effective because it allows

their income to be calculated based on

gross deposits. It is important to note that

the final qualifying income for buisnesses

deposits is less than direct personal

deposits for services rendered.

Is a Self Employed Heloc Second

Mortgage the same as a Stand Alone

Second Mortgage

YES! Usually a Stand Alone Second are

advertised using tax returns to qualify not

bank statement deposits. At 1st Florida

Lending, we do offer both Bank Statement

Deposit and (“full doc stand alone second

mortgages”) using gross tax return and W2

income at a lower rate.

Borrowing Matrix

Eligible Borrowers

•

US Citizens

•

Permanent Resident Aliens

•

Non-Permanent Resident Aliens

o

Visa E/G/H/L/O/P/TN

•

Non-Occupant Co-Borrowers

Loan Amount

•

Minimum Loan Amount $200,000

•

Max Loan Amount $1,000,000

Ineligible Borrowers

•

Foreign Nationals

•

Irrevocable Trusts or Land Trusts

•

Diplomatic immunity

Qualifying Income Documentation

•

Full Doc - 1 Year Tax Returns

•

Stated - 12 months Bank Statements

Reserves

•

Cash out may be used for reserves

•

No Gifts of equity allowed

Eligible Property Types

•

Primary Home: No reductions

•

Second Home

•

Investment Property

•

2-4 Multi Family Unit

•

Condos: FNMA Warrantable

•

Non-Warrantable Condo ( case by

case only)

Ineligible Property Types

•

Condotels

•

Rural/Ag or Vacant Land

•

Unique(dome, berm,etc)

•

Condition C5 or C6

•

Manufactured/Mobile homes

•

Co-ops

•

Mixed-use

Appraisal Type

•

AMC Appraisal Only

SELF-EMPLOYED HELOC

SECOND MORTGAGE

OBTAIN CASH OUT FROM THE EQUITY ON YOUR

PRIMARY OR SECOND HOME WITHOUT TOUCHING

YOUR 1ST MORTGAGE ALREADY IN PLACE !