1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

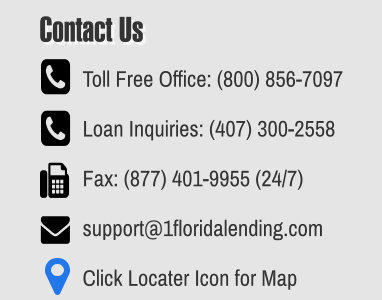

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

ASSET DEPLETION LOANS

Asset Based Mortgage

Aka Asset Depletion Loan

Asset Depletion Loans are a type of home

loan that allows borrowers to qualify

based on their liquid assets rather than

traditional income sources like a salary or

self-employment income. This type of loan

is particularly useful for retirees, high-net-

worth individuals, or those with substantial

savings but little to no regular income.

How it Works:

•

Underwriting uses a formula to

determine how much of a borrower's

assets can be used as "income."

•

Typically, they divide the total

eligible assets by a set number of

months (Example: divide your liquid

assets by 60 which equals your

qualifying monthly income and loan

amount. Please

•

Note: Not all assets value are

counted the equally. The resulting

figure is treated as monthly income

for loan qualification purposes.

Eligible Assets May Include:

•

Cash in savings or checking

accounts

•

Investment accounts (stocks,

bonds, mutual funds)

•

Retirement accounts (some lenders

apply discounts to these)

Certificates of Deposit (CDs)

Highlights:

•

Max Loan Amount $5,000,000

•

Min Loan Amount $200,000

•

Minimum Credit Scores start at 660

•

As little as 20% down payment for

purchases available

•

No employment or income (Ability-

to-Repay (ATR) is determined by

assets. In some cases, if assets

alone do not suffice, it may be

combination with bank statements,

W2 and other qualified income with

underwriting approval

•

Cash-out and Interest-only options

available

•

Property Types ( Primary, 2nd

Homes & Investment Properties)

•

Non-Warrantable Condos, Co-ops

and Condotels OK

•

Reserves vary (3 to 6 months) based

on program

•

No rate adjustments apply to the

program

•

Only one appraisal required

regardless of loan amount or cash

out

•

Debt to Income (DTI) Ratio not

calculated (in most cases)

Note: Mortgage Asset Loan income can

be used in conjunction with all other

income sources such as W2, self-

employed, pension, Social Security or

rental income

What are the Benefits of an Asset

Depletion Loan:

An Asset Depletion Loan offers several

benefits for borrowers who may not

have a steady income but possess

significant financial assets. Here are the

key advantages:

1.

No Traditional Income

Requirements: Borrowers do not

need to show a regular paycheck or

W-2 income. Ideal for retirees, self-

employed individuals, and high-net-

worth individuals with substantial

savings.

2.

Leverages Liquid Assets for Loan

Qualification: Underwriting

considers assets such as cash,

stocks, bonds, and retirement

accounts instead of employment

income. This provides flexibility for

those with wealth tied up in

investments.

3.

Higher Loan Approval Chances:

Applicants who might struggle to

qualify under conventional income-

based lending guidelines can still

secure a mortgage. Particularly

beneficial for entrepreneurs and

freelancers with fluctuating

incomes.

4.

Can Be Used for Primary and

Secondary Homes: These loans can

be used for purchasing a primary

residence, a vacation home, or even

an investment property.

5.

Potential for Lower Debt-to-Income

Ratio (DTI): Because income isn’t

calculated traditionally, borrowers

with large assets may appear to

have a lower DTI, improving loan

approval odds.

6.

No Need for Tax Returns or

Extensive Employment Verification:

This streamlines loan processing

especially for those with complex

tax situations.

7.

Greater Flexibility in Loan

Structuring: We offer various

repayment terms and down

payment options tailored to asset-

rich borrowers.

8.

Can Help Avoid Liquidating

Investments: Instead of selling off

assets (which could trigger capital

gains taxes or disrupt financial

strategies), borrowers can use their

existing wealth as collateral.

Who Benefits from an Asset

Depletion Loan?

•

Retirees with significant savings but

no steady paycheck.

•

Self-employed individuals who

prefer to use their liquid assets

rather than reported taxable income.

•

Investors or high-net-worth

individuals with substantial non-

wage wealth.

Key Considerations:

This type of loan typically requires a large

amount of liquid assets to qualify. Also,

interest rates may be slightly higher than

conventional loans.

Final Thoughts

A property appraisal is a critical tool for

ensuring fair and transparent property

transactions. Whether you're buying,

selling, refinancing, or settling legal

matters, an accurate appraisal provides

the objective property value needed for

making informed financial decisions.

Need help with your mortgage process?

Call 1st Florida Lending at 407-300-2558

for expert guidance!

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County