1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

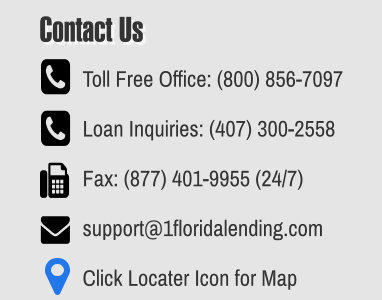

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

No Doc Funding Loan

Options for both non-owner-

occupied and Investment /

Commercial Properties as

well as owner-occupied

Primary and Second Homes

With our No Doc funding options for

investors, commercial properties and

primary homes you can say goodbye to

the extensive paperwork and

documentation who may not have the

traditional documentation required for a

full funding approval. It is important to

note that some of these program start

in the 6's and may vary depending on

which program you choose that meets

your criteria. It is important to note that

the availability and terms of these loans

may vary depending on which program

meets your specific criteria and market

conditions.

We offer a range of No Doc Funding

Options, for non-owner-occupied

investment and commercial properties;

to owner-occupied primary, second and

some investment properties to best fit

your unique scenario. Our team of

experts is dedicated to helping you find

the right funding solution that meets

your needs and goals. Contact us today

to learn more about these program

options and how we can assist you in

achieving your financial objectives.

.

Which No Doc or Stated Funding

Program Meets Your Criteria?

NO DOC FUNDING

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County

1. Investment & Hold Properties

Obtaining a Real Estate Investment

Property Loan can help take your

investing needs to the next level with kinds

of property types the single-family, multi-

family etc..with lowest interest rates >

Learn More

2. Rental Investment Loans:

An appraisal company determines the

estimated qualifying rental income based

on comparable owner-occupied

properties in the surrounding area to

obtain a loan approval. > Learn More

3. Commercial Property Loans:

We have been a full range of Commercial

Real Estate and Investment Funding in

Florida since 2007,. with fast closings by

seasoned and licensed loan officer

professionals. > Learn More

4. No Doc (Hard Money) Loans:

No credit check, no bank statement

calculations, no financial’s required…

basically nothing! We underwrite this loan

based on the “as is” quality of the

property… not the borrower!

> Learn More

5. Fix & Flip Bridge Loans:

A short-term 1 year, interest only

(“Bridge”) loan to purchase non-owner

occupied properties to hold and sell with

no pre-payment penalty. Ask about our 2

year option > Learn More

5. Foreign National Loans

Our Foreign National Loans cater to

nonresidents of the United States who

wish to purchase a vacation home,

second home, or investment property

with no docs. > Learn More

1. Asset Based Funding Loans:

Allows borrowers to use their liquid

assets to qualify for the purchase or

refinancing a primary and/or second

home based on assets instead of

traditional verification. > Learn More

2. Self-Employed Funding Loans:

Tailored for self-employed individuals or

business owners, with qualifying income

based on 12 and 24 month bank

statement deposits instead of using tax

returns > Learn More

Two (2) Low Doc Funding

options for owner-occupied

Primary, Second Homes and

Investment properties

Choose a link below to obtain

a Quick Quote for a specific

Low Doc Stated Funding Loan

1.

Stated Funding Primary Loans

>Request Free Quote

2.

Asset Based Funding Loans

>Request Free Quote

3.

Self-Employed Funding Loans

>Request Free Quote