1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

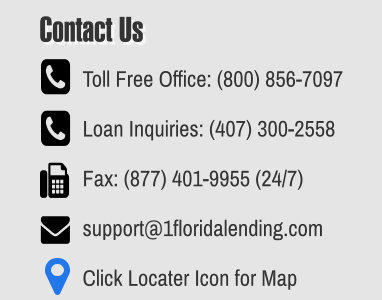

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

TURNED DOWN BY YOUR LENDER? CALL US!

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County

NO DRAMA… NO RED TAPE… NO ENDLESS DOC LOOP

RATES DIRECT WITH UNDERWRITING

Fast Approvals

Streamlined Underwriting

Approvals in 24 hours

Close in as little as 20 days

Easy Process

No Income Verification

No Tax Returns Needed

No or Min Credit Required

Reliable Partner

25+ Years of Experience

Direct Private Lender

What is a Bridge Loan?

A Bridge Loan is a short-term financing

solution, often used in both residential

and commercial real estate

transactions. These loans are designed

to "bridge" the gap between immediate

financial needs and future plans. Bridge

Loans are especially helpful for investors

needing flexibility in fix-and-flip projects,

or to overcome loan denials.

Unlike traditional loans, bridge loans do

not require income or employment

verification and are based on the

properties appraised value and proof of

funds to close, along with some

reserves.

Most programs do not require a credit

score, and other programs require a

minimum FICO of 620 or higher score

may help secure a more favorable

interest rate. Typical closing timelines

range from 20 to 25 business days.

Bridge loans for fix and flip

Residential properties and

Commercial properties

A bridge loan for a fix-and-flip project is

primarily categorized as a residential

properties, but it can also sometimes be

considered a commercial property loan,

depending on specific factors. Here's a

detailed explanation:

Bridge Loan as a Residential Real Estate

Properties

Residential Properties (1-4 Units): When

the fix-and-flip project involves

residential properties like single-family

homes, duplexes, or small multi-family

units (1-4 units), the bridge loan is

typically seen as a real estate

investment loan. The main objective of

a fix-and-flip loan is to quickly purchase,

renovate, and resell the property for a

profit. This makes it an investment-

driven loan, which falls under real estate

investment financing.

Program Highlights for 1 & 2 year

Residential Fix-and-Flips

This is a great program for investors that

fix and flip properties quickly and

sometimes can be extended for up to 2

years if you know will take longer than 1

year to avoid the stress of securing a

refinance in the middle of your project,

use our 2-year fix and flip loan. We offer

acquisition and renovation costs on 2-

year fix and flip loans just as we do on

our 1-year loans.

What Makes our Bridge Loans so

Attractive?

•

No income, No DTI and No FICO with

most programs

•

No prepayment penalty on 1-year

Interest-only terms

•

Full appraisals only required on case-

by-case basis

•

Loan can be extended for an

additional year

•

100% Rehab Financing

•

Low rates

•

Up to 85% LTV for residential and

75% for commercial properties

purchases

Bridge Loan as a Commercial

Property Loan

Larger or Commercial Properties: If the

fix-and-flip involves larger properties

such as multi-unit buildings (5+ units),

mixed-use developments, or purely

commercial spaces (like office buildings

or retail centers), the bridge loan may be

categorized as a commercial loan.

Why Choose Us?

•

Competitive Rates: Get the best rates

in the market.

•

Flexible Terms: We offer loan terms

that suit your business.

•

Fast Approval: Our streamlined

process gets you financing quickly.

•

Expert Advice: Work with

professionals who understand the

commercial real estate market.