1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

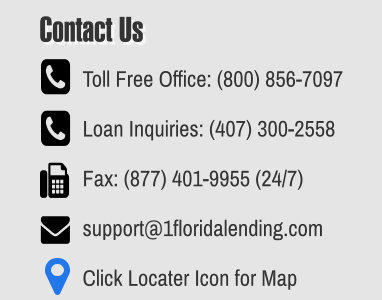

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

Conventional Loans: Smart

Financing for Primary and Second

home financing and refinancing,

Investors & Homeowners

---------------

Ask us about our 99% LTV

conventional loan program

What are the main differences in the 3%

down payment vs. 5% down payment

Conventional Loan?

Whether you're a first-time buyer or

planning your next move, choosing

between a 3% or 5% down payment on a

conventional loan can make a big

difference in your upfront costs and long-

term mortgage strategy. Let’s break it

down.

1. Conventional 3% Down Payment Loan

Mortgages that only require a 3 percent

down payment are often part of a special

program, and they’re open to anyone who

meets the program requirements.

Typically, you must be a first-time

homebuyer or have not owned a home

over the past few years to qualify;

generally, you must also meet the

program’s income limits

The down payment doesn’t have to come

from your savings, the funds can be a gift

from a friend or relative, grant or other

form of assistance. However, borrowers

must meet certain qualifications to obtain

this mortgage, including:

•

First-time homebuyer: At least one of

the loan applicants must be a first-

time homebuyer or not have owned a

home in the past three years.

•

Homeownership education course: If

all the borrowers are first-time buyers,

at least one borrower must complete a

homebuyer education course.

•

Debt-to-income (DTI) ratio and credit

score: You must meet conventional

DTI requirements and have a credit

score of 620 or higher.

•

Residential requirements: The home

you’re buying must be your primary

residence, meaning you intend to live

in it.

•

Conforming loan limitations: The

purchase price of the home cannot

exceed current conforming loan limits,

which for 2025 is $806,500 for a one-

unit property in most parts of the

country; in more expensive areas, the

loan limit is $1,209,750.

2. Conventional 5% Down Payment Loan

Looking for a flexible, affordable home

loan? Our 5% down conventional loan may

be the perfect fit. Ideal for both first-time

homebuyers and seasoned homeowners,

conventional loans offer competitive

interest rates, lower costs, and

customizable terms.

Whether you're buying your dream home,

refinancing your current mortgage, or

investing in property, conventional loans

provide flexible options to suit your

financial goals.

Why Choose a 5% Conventional Loan?

•

Competitive Interest Rates vs. the 3%

down conventional loan

•

A minimum credit score of 620 or

higher

•

Debt-to-income (DTI) ratio up to 50%

•

Homeownership Education: Is not

required)

•

Flexible Terms – 10, 15, 20, or 30

yearsIdeal for Primary Residences,

Second Homes & Investment

Properties

Types of Conventional Loans We Offer

•

Fixed-Rate Mortgages: Stable monthly

payments for the life of the loan

•

Adjustable-Rate Mortgages (ARMs):

Lower initial rates with flexible

adjustments

•

Conforming Loans: Meet Fannie Mae

and Freddie Mac guidelines

•

Non-Conforming Loans: Jumbo loans

for high-value properties

Ready to Get Started?

Whether you're buying, refinancing, or just

exploring options, our expert mortgage

team is here to help. We’ll guide you

through every step of the loan process to

ensure you find the best solution for your

needs.

•

Get Pre-Qualified in Minutes

•

Talk to a Loan Expert Today

•

Make Your Homeownership Dream a

Reality

Mortgage Insurance Requirements

It is important to note that because you’re

putting less than 20 percent down on the

home you’ll need to pay private mortgage

insurance (PMI) with your monthly

mortgage payment. Once you have 20

percent equity in your home, you can stop

paying PMI. Again, this rule applies to

any conventional loan program.

Call us today or fill out our Request a

Rate questionnaire below to see how a

conventional loan can work for you.

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County