This loan program offers

financing for Undocumented /

Non-US Citizens / Foreign

National Borrowers living and

working in Florida who have a

valid passport from their country

of origin and current ITIN ID card

to purchase a primary home in

FLORIDA. Including DACA status

At 1st Florida Lending, we offer an

affordable ITIN mortgage loans that allows

the Non-Us Citizens who live and work in

Florida to purchase home. Many of our

Undocumented / Non-US Citizens / Foreign

National immigrant population do not have

a Social Security numbers and have limited

credit history or no Credit History which

often disqualifies them from obtaining an

FHA or Conventional Mortgage.

Q. Do I need to have a perfect credit score

to receive a mortgage? *

A. No, if you not have not established

credit and pay your utilities, car payments,

etc.. on time with good spending habits.

We can establish the required credit score

of 640 using your trade-lines.

Q. What type of income do I need to

provide?

•

Are you Self-Employed ?

Use bank statements (personal/business)

to document your income - No Tax returns

or W-2 required !

Your income must be generated in the USA

– no overseas income allowed

•

Are you a Wage Earner ?

Use No Tax returns or W-2 to document

your income

Your income must be generated in the USA

– no overseas income allowed

Identification

A Valid Passport from your country of

origin (or) State ID is required

No Credit Score ? No Problem

If you have an ITIN tax number and have

not established a credit score with 3 or

more trade-lines, you can establish a 620

score by providing us with 12 months of

on-time payments for 3 alternative sources

(rent, utilities, cell, insurance, etc.).

Gift Funds For Down Payment ?

Family members can help with your down

payment reducing the borrowers down

payment to 5%

ITIN mortgage loans provide an

opportunity at home ownership for

undocumented immigrants. Neither

citizenship or a social security number are

required. To apply for an ITIN loan, you

may do so using your ITIN number

(individual tax identification number).

1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

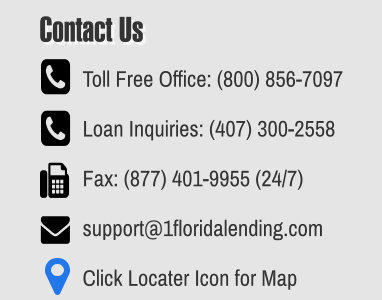

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

Program Highlights

•

Min. Loan is $150,000

•

90% LTV / with 720 credit / W2 wage

earners or self-employed

•

85% LTV/ min 700 credit / W2 wage earners

or sefl-employed

•

80% LTV with credit scores from 660 to 719

•

75% LTV if below 660 or no credit score

•

Single Family, Town-house, Multi Family,

Mobile, Condo

•

New purchases, refinance and cash-out

available

•

No pre-payment penalties

•

No mortgage insurance

•

Owner Occupied Only

Our ITIN & DACA Loan program offers

potential home ownership for the

undocumented / foreign national

borrower who lives and works in

Florida as well as pays US taxes to the

IRS with the ITIN Tax ID (instead of a

Social Security number) to purchase a

Primary Home

TURNED DOWN BY YOUR LENDER? CALL US!

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County