1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

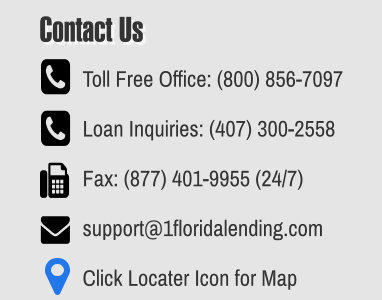

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

Refinancing Your Mortgage

Mortgage refinancing can help

you change your loan terms or

put home equity to work.

Refinancing your mortgage is replacing your

current mortgage with a new one. The new loan

pays off the old mortgage and you’ll start making

payments on the new mortgage. You can

refinance your mortgage for all sorts of reasons

including lowering their monthly payment, getting

a better interest rate, taking cash out of their

home, shortening their loan term, or a

combination of the above.

Borrowers with perfect credit

For borrowers with a perfect credit history,

refinancing can be a good way to convert a

variable loan rate to a fixed, and obtain a lower

interest rate. Borrowers with less than perfect, or

even bad credit, or too much debt, refinancing can

be risky.

There are three Types Of

Refinance Mortgages

Refinance mortgages come in three varieties —

rate-and-term, cash-out, and cash-in. The

refinance type that’s best for you will depend on

your individual circumstance. Rates vary between

the three types.

Rate-And-Term Refinance

In a rate-and-term refinance, the only terms of the

new loan which differ from the original one are

either the mortgage rate, the loan term, or both.

Loan term is the length of the mortgage. For

example, in a rate-and-term refinance, a

homeowner may refinance from a 30-year fixed

rate mortgage into a 15-year fixed rate mortgage;

or, may refinance from a 30-year fixed rate

mortgage at 6 percent mortgage rate to a new, 30-

year mortgage rate at 4 percent.

With a rate-and-term refinance, a refinancing

homeowner may walk away from closing with

some cash, but not more than $2,000 in cash. A

“No cash out” refinance mortgages allow for

closing costs to be added to the loan balance, so

that the homeowner doesn’t have to pay costs out-

of-pocket.

Cash-Out Refinance

In a cash-out refinance, the refinance mortgage

may optionally feature a lower mortgage rate than

the original home loan; or shorter loan term, such

as moving from a 30-year mortgage to a 15-year

mortgage.

However, the defining characteristic of a cash-out

mortgage is an increase in the amount that’s

borrowed.

With a cash-out refinance, the loan balance of the

new mortgage exceeds than the original mortgage

balance by five percent or more. Because the

homeowners only owes the original amount to the

bank, the “extra” amount is paid as cash at closing,

or, in the case of a debt consolidation refinance,

directed to creditors such as credit card

companies and student loan administrators. Cash-

out mortgages can also be used to consolidate

first and second mortgages when the second

mortgage was not taken at the time of purchase.

Cash-out mortgages represent more risk to a bank

than a rate-and-term refinance mortgage and, as

such, carry more strict approval standards. For

example, a cash-out refinance may be limited to a

lower loan size as compared to a rate-and-term

refinance; or, may require higher credit scores at

the time of application. Most mortgage lenders

will limit the amount of “cash out” in a cash-out

refinance mortgage to $250,000.

Cash-In Refinance

Cash-in refinance mortgages are the opposite of

the cash-out refinance.

With a cash-in refinance, a refinancing homeowner

brings cash to closing in order to pay down the

loan balance and the amount owed to the bank.

The cash-in mortgage refinance may result in a

lower mortgage rate, a shorter loan term, or both.

There are several reasons why homeowners opt

for cash-in refinance mortgages. The most

common reason to do a cash-in refinance to get

access to lower mortgage rates which are only

available at lower loan-to-values. Refinance

mortgage rates are often lower at 75% LTV, for

example, as compared to 80% LTV. Another

common reason to cash-in refinance is to cancel

mortgage insurance premium (MIP) payments.

When you pay down your loan to 80% LTV or lower

on a conventional loan, your mortgage insurance

premiums are no longer due. Less Paper Work

Required for Refinances

When you do a mortgage refinance, you are

establishing a brand-new loan with brand-new

terms. Typically, this subjects a refinance applicant

to the same mortgage approval process as with a

purchase mortgage applicant.

In other words, the refinance applicant is

evaluated in three specific areas:

1.

Credit Score and Payment History

2.

Income and Employment History

3.

Retirement Assets and Cash Reserves

Furthermore, also like a purchase, the home being

refinanced is subject to a home appraisal in order

to affirm its current market value. Despite the

similarities, though, borrowers can usually expect

to provide less documentation for a refinance

mortgage as compared to a purchase especially if

you refinance with the same lender.

You will still be asked to provide proof of income

using W-2s and pay stubs; proof of assets via bank

statements; and proof of citizenship or U.S.

residency status. But, you will not be asked to

provide information related to the original transfer

of the home. We can close your refinance

mortgage usually in 21 days

Some Refinances like FHA,USDA

and VA Don’t Require

Verifications

Refinance mortgages typically require the

verification of a borrower’s income, assets, and

credit. However, there are certain refinance

programs for which verifications can be bypassed.

These programs are called “streamlined”

refinances. They’re called streamlined refinances

because their underwriting requirements are

grossly simplified and designed to be speedy.

With a streamline refinance, mortgage lenders

waive large parts of their “typical” refinance

mortgage approval process. Often, home

appraisals are waived, income verifications are

waived, and credit scores verifications are waived.

Different lenders may deploy different overlays for

each of the streamlined programs, but the

programs can be summarized as follows.

The FHA Streamline Refinance

The FHA Streamline Refinance program waives all

verifications and refinance mortgage rates are as

low as with a standard-verification FHA-backed

loan and requires refinancing homeowners to save

five percent or more on their mortgage payment;

and, to show a history of on-time payments to

their lender.

Cash-out refinance mortgages are not allowed

via the FHA Streamline Refinance program.

The VA Streamline Refinance

The VA Streamline Refinance is available to

homeowners with an existing VA-backed

mortgage.

Officially known as the VA Interest Rate Reduction

Refinancing Loan (IRRRL), the VA Streamline

Refinance also waives income, asset, and credit

score verifications. Refinancing VA homeowners

are required to demonstrate that the refinance

mortgage will result in monthly payment savings,

except for homeowners changing to a shorter loan

term, such as from a 30-year mortgage to a 15-

year mortgage; or, from an ARM to a fixed-rate

loan.

Homeowners may not receive cash-out as part of a

VA Streamline Refinance.

USDA Streamline Refinance

The USDA Streamline Refinance Program is

available to homeowners with existing USDA home

loans. USDA loans are loans for homeowners in

rural or suburban areas which allow for up to

100% financing. The USDA Streamline Refinance

Program does not verify income, assets or credit;

and, homeowners using the program to refinance

are limited to 30-year fixed rate mortgages and 15-

year loans. ARMs are not allowed. Cash-out

refinance mortgages are not allowed via the

USDA Streamline Refinance.

TURNED DOWN BY YOUR LENDER? CALL US!

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County