FHA is one of the most popular loan options

because it provides a more lenient credit and

income requirements than other mortgages.

Also FHA Loans are guaranteed by the federal

government and easier to qualify for than a

conventional loan. FHA loans allow for lower

credit scores than conventional loans and, in

some cases, lower monthly mortgage

insurance payments

Advantages of FHA Loans

•

You can qualify with a lower credit

score compared to other loans.

•

You can buy a home with a down

payment as low as 3.5%.

•

You may qualify even if you’ve had

financial difficulties in the past, like a

bankruptcy.

•

If you already have an FHA loan, you

can refinance with FHA Streamline to

lower your interest rate.

•

You offer lender credits to pay for your

closing costs for both purchase and

refiance

The Benefits of Getting an FHA Loan

from 1st Florida Lending

•

We are FHA-approved lender and

process FHA loans every day.

•

Our process is completly digital which

means saves time with paperwork.

•

We have FHA Loan experts available to

help you understand whether an FHA

loan is the right Load for you.

•

We offer great customer service whcih

continues after you close.

How FHA Loans Work

•

You get an FHA loan from an FHA-

approved mortgage lender.

•

The loan is insured by the Federal

Housing Administration.

•

Because of that insurance, the credit

and income requirements for an FHA

loan are more lenient.

•

To help fund the FHA program, in most

cases you’ll pay mortgage insurance,

which is added on to your monthly

payment.

•

The home you want to buy will have to

meet the FHA’s minimum property

standards.

WE OFFER THREE (3) FHA LOAN

PROGRAMS

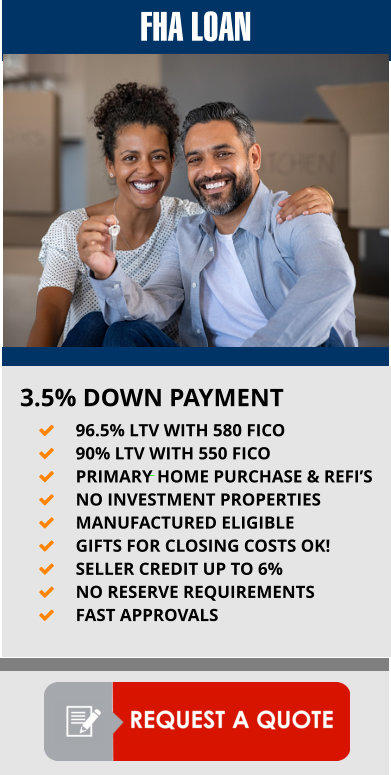

PROGRAM 1. THE STANDARD FHA

LOAN WITH 3.5% DOWN PAYMENT

OF THE PURCHASE PRICE FOR A

PRIMARY HOME. REFINANCING IS

AVAILABLE!

•

Min Loan $125,000 up to FHA Loan

Limits

•

580 FICO 3.5% Down Payment

•

No tradelines required

•

550 FICO up to 5% Down Payment

•

500 to 550 10% Down Payment

•

Terms 30yr / 25yr /15yr Fixed

•

Two Year Tax Returns

•

W-2 & Paystubs only - OK

•

Manufactured Homes OK

•

Self-Employed Borrowers OK

•

DACA / Dreamers OK

CLICK TO REQUEST QUOTE

PROGRAM 2. DOWN PAYMENT

ASSISTANCE FOR FIRST TIME HOME

BUYERS

Q. How Does Down Payment Assistance

Work?

•

Down payment assistance programs

work by helping first-time home buyers

purchase homes with little or none of

their own money or down payment.

•

Down payment assistance programs are

administered on the federal, state, and

local levels. Federal DPA programs

include first-time home buyer tax credits,

cash grants to buy homes, and interest

rate subsidies for higher home

affordability.

•

Most DPA programs, though, are

administered by state and local

governments, and by private entities and

charitable organizations. Non-federal

programs may require buyers to use

specific mortgage loan types such as FHA

loans; and, may require additional

paperwork not associated with the

mortgage application.

•

Down payment assistance is sometimes

paid as cash at closing or before. Other

times, they’re awarded as forgivable

loans and paid at the time of closing.

Q. How many types of down payment

assistance programs are their?

The programs available for down payment

assistance generally fall into one of three

categories as briefly define below.

•

Grants: A grant is free money that you

can put toward your home purchase. It

doesn’t have to bepaid back.

•

Forgivable loans: Forgivable loans are

loans that won’t have to be paid back as

long as you meet certain conditions

defined by the assistance program. A lien

is placed on your home, but it’s removed

once the loan is either forgiven or paid

back.

•

Deferred payment loan: A deferred

payment loan is one that must be repaid,

but not right away. You pay it back at

some point down the line. This isn’t

always the case, but they often come at

0% interest. Again, a lien is placed on

your home until repayment.

HIGHLIGHTS

•

Primary Home Purchase only

•

No Investment Properties

•

Manufactured Homes Eligible

•

Must be a First Time Home Buyer

•

Online DPA counseling required

•

Seller credits up to 6%

•

No Reserve Requirements

•

Fast Approvals

CLICK HERE TO REQUEST QUOTE

PROGRAM 3. MAX FHA PROGRAM -

ZERO DOWN PAYMENT OPTION

ZERO DOWN PAYMENT MAX FHA LOAN is

a No Down Payment Assistance Program

helps Non-First Time Borrowers obtain a

100% CLTV (Combined loan-to-value

ratio) or No Down Payment and you DO

NOT HAVE TO BE a FIRST-TIME HOME

BUYER!

How Does Down MAX FHA WORK?

Down payment assistance programs work

by helping first-time home buyers purchase

homes with little or none of their own

money or down payment.

MAX FHA LOAN is a down payment

assistance program that helps non-first-

time borrowers obtain a 100% CLTV

(Combined loan-to-value ratio) or ZERO

DOWN PAYMENT

HIGHLIGHTS

•

100% CLTV FHA Loan (Combines 1st and

Subordinate Lien)

o

2nd lien with an interest rate 2%

greater than 1st lien

o

Payment amortized over 10 years

•

No first-time homebuyer requirement

•

Non-occupant co-borrowers allowed

•

600 Minimum FICO

•

Borrower’s minimum contribution of

$0.00

•

PRIMARY HOME PURCHASE ONLY

•

You do not have to be a first time home

buyer!

•

Loan amount to Conforming limits

•

Conforming balance only

•

No income limit

Eligible Properties:

•

Single Family Residences

•

2 units - LLPA applies

•

PUDs

•

Townhouses

•

Condominiums (Must not be in

litigation). Must be FHA Approved

•

Double wide manufactured housing

available

CLICK HERE TO REQUEST QUOTE

Do you have FHA Loan Credit Issues?

As FHA lenders, we will review your past

credit performance while underwriting your

loan. A good track record of timely

payments will likely make you eligible for an

FHA loan. The following list includes items

that can negatively affect your loan

eligibility:

No Credit History

If you don't have an established credit

history or don't use traditional credit, your

lender must obtain a non-traditional

merged credit report or develop a credit

history from other means.

Bankruptcy

Bankruptcy does not disqualify a borrower

from obtaining an FHA-insured mortgage.

For Chapter 7 bankruptcy, at least two

years must have elapsed and the borrower

has either re-established good credit or

chosen not to incur new credit obligations.

Late Payments

It's best to turn in your FHA loan application

when you have a solid 12 months of on-

time payments for all financial obligations.

Foreclosure

Past foreclosures are not necessarily a

roadblock to a new FHA home loan, but it

depends on the circumstances.

Collections, Judgements, and Federal

Debt

In general, FHA loan rules require the

lender to determine that judgments are

resolved or paid off prior to or at closing.

CLICK HERE TO REQUEST QUOTE

WE OFFER A ZERO DOWN PAYMENT OPTION

1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

FHA HOME LOAN PROGRAM

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County