1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

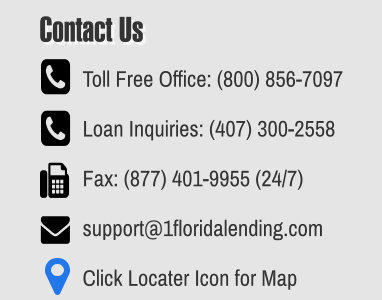

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

One-Time Close Construction Loan

(Single-Close Construction-to-

Permanent)

Build your new home from the ground

up—and seamlessly convert it to a

permanent mortgage all with one loan.

At 1st Florida Lending, our One-Time

Close Construction Loan (also called a

Single-Close Construction-to-

Permanent Loan) covers land purchase,

construction costs, and permanent

financing in a single approval and

closing.

Ready to break ground on your dream

home? Click Here to Get Started

What Is a One-Time Close Construction

Loan?

A One-Time Close Construction Loan

streamlines your financing:

Single application & closing:

No need for separate

construction and mortgage

loans.

Land purchase + build +

permanent mortgage: Funds

land acquisition, construction

draws, then converts to a 15 or

30 year fixed terms.

Interest-only payments during

build: Keep costs down while

your home is under

construction.

Use this construction-to-perm

mortgage to build primary residences,

vacation homes, or investment

properties without the hassle of two

closings.

How It Works

1.

Apply once for both

construction and permanent

financing.

2.

Close once: pay just one set of

closing costs.

3.

Draw funds: as your project

progresses (foundation,

framing, finishing).

4.

Convert automatically to a

traditional mortgage: (15- or

30-year term) when

construction ends.

5.

Enjoy fixed rates: and

predictable payments on your

completed home.

Typical construction period: up to 12

months (it varies by project).

Why Choose 1st Florida

Lending?

Competitive rates: on both

construction and permanent

financing

Flexible draw schedule: tailored to

your build timeline

Expert guidance: through every

phase form land purchase to

construction draws, inspection,

and permanent conversion

Interest-only payments: during the

build phase to manage cash flow

Local expertise: Deep knowledge

of Florida construction costs,

permitting, and market trends

Loan Options

Conventional One-Time Close

Down payment: From 5%

Credit & income: Standard Fannie

Mae/Freddie Mac guidelines

Best for: Borrowers with strong

credit and stable income seeking

low rates

VA One-Time Close

Zero down financing (on loans up

to $1 million)

No mortgage payments until

move-in

Eligibility: U.S. veterans, active-

duty military, and qualifying

spouses

Benefit: Backed by the VA for

competitive rates and low fees

Frequently Asked Questions

Q: How long does construction take?A:

Most projects close within 9 to 12

months, but timelines vary. We’ll work

with your builder’s schedule and local

permitting process.

Q: Can I build a rental property? A: Yes,

use a One-Time Close loan for primary,

secondary, or investment homes.

Q: What credit score do I need? A:

Scores of 680+ typically qualify for

conventional programs; VA borrowers

follow VA requirements.

Q: Are there prepayment penalties? A:

No. After conversion to a permanent

mortgage, you can pay off or refinance

your loan at any time without penalty.

Get Started on Your New Build

Today

Turn your vision into a reality with 1st

Florida Lending’s streamlined

construction-to-permanent financing.

Contact Us for a Free Pre-Approval or

call (800-655-1345) or

Click Here to Get Started

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County