1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

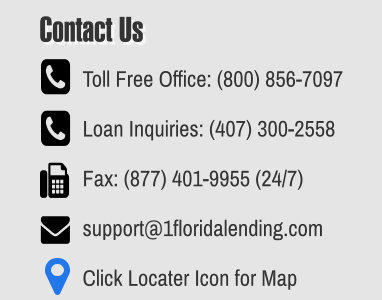

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

TURNED DOWN BY YOUR LENDER? CALL US!

LEARN ABOUT YOUR CREDIT

What is a credit report ?

Your credit payment history is recorded in a file or

report. These files or reports are maintained and

sold by "consumer reporting agencies" (CRAs).

One type of CRA is commonly known as a credit

bureau. You have a credit record on file at a credit

bureau if you have ever applied for a credit or

charge account, a personal loan, insurance, or a

job. Your credit record contains information about

your income, debts, and credit payment history. It

also indicates whether you have been sued,

arrested, or have filed for bankruptcy.

Do I have a right to know what's in my report?

Yes, if you ask for it. The CRA must tell you

everything in your report, including medical

information, and in most cases, the sources of the

information. The CRA also must give you a list of

everyone who has requested your report within

the past year-two years for employment related

requests.

What type of information do credit bureaus

collect and sell?

Credit bureaus collect and sell four basic types of

information:

Identification and employment information

Your name, birth date, Social Security number,

employer, and spouse's name are routinely noted.

The CRA also may provide information about your

employment history, home ownership, income,

and previous address, if a creditor requests this

type of information.

Payment history

Your accounts with different creditors are listed,

showing how much credit has been extended

and whether you've paid on time. Related events,

such as referral of an overdue account to a

collection agency, may also be noted.

Inquiries

CRAs must maintain a record of all creditors who

have asked for your credit history within the past

year, and a record of those persons or businesses

requesting your credit history for employment

purposes for the past two years.

Public record information

Events that are a matter of public record, such as

bankruptcies, foreclosures, or tax liens, may

appear in your report

What is credit scoring?

Credit scoring is a system creditors use to help

determine whether to give you credit.

Information about you and your credit

experiences, such as your bill-paying history, the

number and type of accounts you have, late

payments, collection actions, outstanding debt,

and the age of your accounts, is collected from

your credit application and your credit report.

Using a statistical program, creditors compare

this information to the credit performance of

consumers with similar profiles. A credit scoring

system awards points for each factor that helps

predict who is most likely to repay a debt. A total

number of points -- a credit score -- helps predict

how creditworthy you are, that is, how likely it is

that you will repay a loan and make the payments

when due.

Because your credit report is an important part of

many credit scoring systems, it is very important

to make sure it's accurate before you submit a

credit application. To get copies of your report,

contact the three major credit reporting agencies:

Equifax: (800) 685-1111

Experian (formerly TRW): (888) EXPERIAN (397-

3742)

Trans Union: (800) 916-8800

These agencies may charge you up to $9.00 for

your credit report.

You are entitled to receive one free credit report

every 12 months from each of the nationwide

consumer credit reporting companies – Equifax,

Experian and TransUnion. This free credit report

can be requested through the following website:

https://www.annualcreditreport.com

Why is credit scoring used?

Credit scoring is based on real data and statistics,

so it usually is more reliable than subjective or

judgmental methods. It treats all applicants

objectively. Judgmental methods typically rely on

criteria that are not systematically tested and can

vary when applied by different individuals.

How is a credit scoring model developed?

To develop a model, a creditor selects a random

sample of its customers, or a sample of similar

customers if their sample is not large enough,

and analyzes it statistically to identify

characteristics that relate to creditworthiness.

Then, each of these factors is assigned a weight

based on how strong a predictor it is of who

would be a good credit risk. Each creditor may

use its own credit scoring model, different scoring

models for different types of credit, or a generic

model developed by a credit scoring company.

Under the Equal Credit Opportunity Act, a credit

scoring system may not use certain

characteristics like -- race, sex, marital status,

national origin, or religion -- as factors. However,

creditors are allowed to use age in properly

designed scoring systems. But any scoring

system that includes age must give equal

treatment to elderly applicants.

How reliable is the credit scoring system?

Credit scoring systems enable creditors to

evaluate millions of applicants consistently and

impartially on many different characteristics. But

to be statistically valid, credit scoring systems

must be based on a big enough sample.

Remember that these systems generally vary

from creditor to creditor.

Although you may think such a system is arbitrary

or impersonal, it can help make decisions faster,

more accurately, and more impartially than

individuals when it is properly designed. And

many creditors design their systems so that in

marginal cases, applicants whose scores are not

high enough to pass easily or are low enough to

fail absolutely are referred to a credit manager

who decides whether the company or lender will

extend credit. This may allow for discussion and

negotiation between the credit manager and the

consumer.

What can I do to improve my score?

Credit scoring models are complex and often vary

among creditors and for different types of credit.

If one factor changes, your score may change --

but improvement generally depends on how that

factor relates to other factors considered by the

model.

Only the creditor can explain what might improve

your score under the particular model used to

evaluate your credit application.

Nevertheless, scoring models generally evaluate

the following types of information in your credit

report:

Have you paid your bills on time? Payment

history typically is a significant factor. It is likely

that your score will be affected negatively if

you have paid bills late, had an account

referred to collections, or declared bankruptcy,

if that history is reflected on your credit report.

What is your outstanding debt? Many scoring

models evaluate the amount of debt you have

compared to your credit limits. If the amount

you owe is close to your credit limit, that is

likely to have a negative effect on your score.

How long is your credit history? Generally,

models consider the length of your credit track

record. An insufficient credit history may have

an effect on your score, but that can be offset

by other factors, such as timely payments and

low balances.

Have you applied for new credit recently?

Many scoring models consider whether you

have applied for credit recently by looking at

"inquiries" on your credit report when you

apply for credit. If you have applied for too

many new accounts recently, that may

negatively affect your score. However, not all

inquiries are counted. Inquiries by creditors

who are monitoring your account or looking at

credit reports to make "prescreened" credit

offers are not counted.

How many and what types of credit accounts

do you have? Although it is generally good to

have established credit accounts, too many

credit card accounts may have a negative

effect on your score. In addition, many models

consider the type of credit accounts you have.

For example, under some scoring models,

loans from finance companies may negatively

affect your credit score.

Scoring models may be based on more than just

information in your credit report. For example, the

model may consider information from your credit

application as well: your job or occupation, length

of employment, or whether you own a home.

To improve your credit score under most models,

concentrate on paying your bills on time, paying

down outstanding balances, and not taking on

new debt. It's likely to take some time to improve

your score significantly.

What happens if you are denied credit or don't

get the terms you want?

If you are denied credit, the Equal Credit

Opportunity Act requires that the creditor give

you a notice that tells you the specific reasons

your application was rejected or the fact that you

have the right to learn the reasons if you ask

within 60 days. Indefinite and vague reasons for

denial are illegal, so ask the creditor to be specific.

Acceptable reasons include: "Your income was

low" or "You haven't been employed long

enough." Unacceptable reasons include: "You

didn't meet our minimum standards" or "You

didn't receive enough points on our credit scoring

system." If a creditor says you were denied credit

because you are too near your credit limits on

your charge cards or you have too many credit

card accounts, you may want to reapply after

paying down your balances or closing some

accounts. Credit scoring systems consider

updated information and change over time.

Sometimes you can be denied credit because of

information from a credit report. If so, the Fair

Credit Reporting Act requires the creditor to give

you the name, address and phone number of the

credit reporting agency that supplied the

information. You should contact that agency to

find out what your report said. This information is

free if you request it within 60 days of being

turned down for credit. The credit reporting

agency can tell you what's in your report, but only

the creditor can tell you why your application was

denied. If you've been denied credit, or didn't get

the rate or credit terms you want, ask the creditor

if a credit scoring system was used. If so, ask what

characteristics or factors were used in that

system, and the best ways to improve your

application. If you get credit, ask the creditor

whether you are getting the best rate and terms

available and, if not, why. If you are not offered the

best rate available because of inaccuracies in your

credit report, be sure to dispute the inaccurate

information in your credit report.

What is the Fair Credit Reporting Act?

The Fair Credit Reporting Act (FCRA) is designed

to help ensure that CRAs furnish correct and

complete information to businesses to use when

evaluating your application.

Your rights under the Fair Credit Reporting Act:

You have the right to receive a copy of your

credit report. The copy of your report must

contain all of the information in your file at the

time of your request.

You have the right to know the name of

anyone who received your credit report in the

last year for most purposes or in the last two

years for employment purposes.

Any company that denies your application

must supply the name and address of the CRA

they contacted, provided the denial was based

on information given by the CRA.

You have the right to a free copy of your credit

report when your application is denied

because of information supplied by the CRA.

Your request must be made within 60 days of

receiving your denial notice.

If you contest the completeness or accuracy of

information in your report, you should file a

dispute with the CRA and with the company

that furnished the information to the CRA.

Both the CRA and the furnisher of information

are legally obligated to re-investigate your

dispute.

You have a right to add a summary explanation

to your credit report if your dispute is not

resolved to your satisfaction.

First Time Home Buyers With Bad Credit

Buying your first home with bad credit can be a

challenge. The underwriting approval process is

fairly strict, however there are options that will

help you make the final decision.

The following government assisted loans are

available to help:

FHA loans are designed to help lower income

level families seeking a mortgage. The benefit is a

3.5% down payment with a minimum credit score

of 580. If your score is below 580, the down

payment is higher up to 10%.

As a first time homebuyer, there are down

payment assistance programs available to you to

let you get into your new home with no money

down.

VA loans are designed for US military veterans. VA

loans allow first time homebuyers to purchase a

home with less-than-average credit with no down

payment, while obtaining low interest rates.

Military personnel, their spouse and reservists are

also eligibile for the VA loan.

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County