1st Florida Lending Corp., a registered Mortgage Lender

Orlando servicing only the State of Florida, offering over

48 loans programs including Conventional Loans, Non-

Conforming Loans, FHA Loans, VA Loans, USDA Loan,

Self-Employed Loans, Bank Statement Loans, No-Doc

Loans, Reverse Mortgage Loans, ITIN Loans, Rental

Investment Loans, to name a few and specializing in

Bank Statement Loans or “stated loans” requiring no Tax

Return verification and much more. * No broker or

lender fees are for FHA,VA, USDA and Conventional

loan types

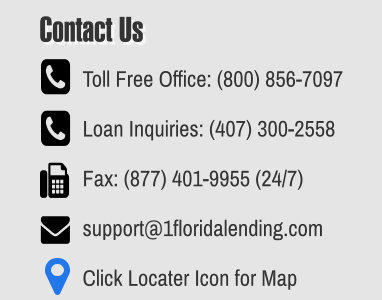

Main Office: 2151 Consulate Dr. * Suite 8 * Orlando,

FL., 32837 * Telephone * (800)856-7097 * (800) 655-

1345 * (407) 300-2558 * Fax (877) 401-9955

* Disclaimer: All Loan programs, rates and terms can

change without notice and are subject to credit and

underwriting approval. Loan charts highlight min/max

constraints, assumptions & random scenarios only. We will

always work hard to approve your loan but there are no

guarantees of any kind expressed or implied that any loan

we be approved. Licensed in Florida Only. When Banks

Say No ! We Say YES ! ® is a registered trademark owned

by 1st Florida Lending Corp. Florida lender license #

MLD106.

© 2007 - 2025 1st Florida Lending Corp. - All rights reserved

TURNED DOWN BY YOUR LENDER? CALL US!

Customer Support

Have a Question, Comment or

Complaints? If YES! We would like to

hear from you. Please complete and submit

our customer support form below and we will

respond promptly

LISTED BELOW ARE THE TOP

FREQUENTLY ASKED CUSTOMER

SUPPORT QUESTIONS.

1. We completed an application Online

and no one has contacted us ?

When you submit an Online application,

you will automatically receive an email

confirmation within minutes. If not,

maybe the email you entered on the form

was incorrect. Not sure? Just resubmit

your request! If it was correct, please

check your junk mail or spam folder.

Why? Sometimes certain email clients

may not recognize emails from

1floridalending.com. If you find our email

domain name 1floridalending.com in your

Spam or Junk folder. Just add the

@1floridalending.com domain or specific

persons at the www.1floridalending.com

to your email contacts and/or safe

senders and/or white list. Also, some

email providers allow you to mark certain

message as “NOT SPAM” or “ALLOW

SENDERS” etc. If your still having

issues, please contact Customer Support

using the form below.

2. We have not been updated on the

status of our loan for many days?

There are no set update timelines on an

active loan file. The frequency of a loan

updates varies throughout the loan

process, but are generally sent twice

weekly after your loan documents are

submitted to our processing/underwriting

department. Updates may increase

depending on the type of loan, requests

for additional documentation, underwriting

issues, holidays, and secondary reviews.

The delivery methods for updates may

vary from email, text message and/or by

telephone.

3. Why are there delays?

Generally speaking, most loans take 21 to

35 days to receive final approval from

underwriting. This timeline starts when a

completed loan file and the required

documentation are submitted to

underwriting for approval. It is important

to note, that there can be a host of

reasons for delays any time throughout

the loan process. On the underwriting

side, the most common delay is when

underwriting requires additional

documentation and/or requests updated

documentation even after issuing a

conditional approval.

On the borrower’s side, there could be

document errors, incorrect information,

missing bank statement pages,

unreadable or illegible documentation,

credit rating changes during the review

period and not providing documents in a

timely manner when requested or

sometimes borrowers fail to disclose

recent purchases, litigation, child support

etc... Needless to say, there are too many

variables to list here and borrowers

should expect the unexpected. The good

news is that these are the exceptions and

not the rule with most of the "issues"

listed above are resolved quickly.

4. Why are the cost, fees, rates and

other charges higher that what is

discussed on the Initial Loan Estimate

and/or Closing Disclosures?

Based on new laws initiated back 2005

that mandated that lenders issue Initial

Loan Estimate and/or Closing Disclosure.

This forced all lenders to overestimate

cost, fees etc ..the Initial Loan Estimate

and/or Closing Disclosure and then

provide borrowers with the final "actual "

numbers (which is usually lower) once

underwriting sends you the Final

LE/Closing Disclosures.

Why, because the new law makes it illegal

for any lender to surprise a borrower with

higher charges on the Final LE/Closing

Disclosures that underwriting sends you

to sign. Simply stated, we can always

raise and overestimate charges, but we

can never change or reduce fee, charges

etc. on the Final LE/Closing Disclosures

once sent by underwriting. In that case

we would have to pay the difference

Below is a broad outline of why lenders

sometimes overestimate fee, charges etc

on a Initial Loan Estimate and/or Closing

Disclosure

•

A change of circumstance

•

You decide to change the kind of loan,

for example moving from an

adjustable-rate to a fixed-rate loan

•

You decide to reduce the amount of

your down payment

•

The appraisal on the home you want

to buy came in lower than expected

•

You took out a new loan or missed a

payment on another loan, and your

credit score has changed

•

Your lender could not verify your

overtime, bonus, or other income

•

The interest rate on your loan was not

locked, and locking the rate caused

the points or lender credits to change

Once you receive the "Final LE/Closing

Disclosures" from underwriting will reflect

the locked rate and actual accounting of

all charges, fees etc including settlement

charges.

5. Processing Fees (1st Florida Lending) • Current Cost: $1,199 per file (this fee can change without notice) • What It Covers: The initial processing of the loan application and file from start to closing If you have any further questions. Please email customer services at support@1floridalending.com

Call 407-300-2558

We offer over 48 loan programs in every

county in the State of Florida as follows;

Alachua County,Baker County,Bay

County,Bradford County,Brevard County,Broward

County,Calhoun County,Charlotte County,Citrus

County,Clay County,Collier County,Columbia

County,DeSoto County,Dixie County,Duval

County,Escambia County,Flagler County,Franklin

County,Gadsden County,Gilchrist County,Glades

County,Gulf County,Hamilton County,Hardee

County,Hendry County,Hernando

County,Highlands County,Hillsborough

County,Holmes County,Indian River

County,Jackson County,Jefferson

County,Lafayette County,Lake County,Lee

County,Leon County,Levy County,Liberty

County,Madison County,Manatee County,Marion

County,Martin County,Miami-Dade

County,Monroe County,Nassau County,Okaloosa

County,Okeechobee County,Orange

County,Osceola County,Palm Beach

County,Pasco County,Pinellas County,Polk

County,Putnam County,Santa Rosa

County,Sarasota County,Seminole County,St.

Johns County,St. Lucie County,Sumter

County,Suwannee County,Taylor County,Union

County,Volusia County,Wakulla County,Walton

County,Washington County