© 2007 - 2025 1st Florida Lending Corp. - All rights reserved I Privacy Policy I Terms of Use I

SELF-EMPLOYED HELOC SECOND MORTGAGE

OBTAIN CASH OUT FROM THE EQUITY ON YOUR PRIMARY OR SECOND HOME

WITHOUT TOUCHING YOUR 1ST MORTGAGE ALREADY IN PLACE !

What is a Self Employed Heloc Second Mortgage?

Homeowners can access cash from their home equity without touching the existing

1st Mortgage at the low rate. We qualify you by calculating 12 or 24 months of your

personal or business bank statements to show proof of income. Tax returns are not

required!

How much can I Borrow on a Self

Employed Heloc Second ?

The amount you can borrow depends on the

remaining equity value of your home, minus

the 1st mortgage you owe. The amount of the

second mortgage can vary, but between 65%-

100% of the equity is a good starting point.

Benefits of a Self Employed Heloc Second Mortgage?

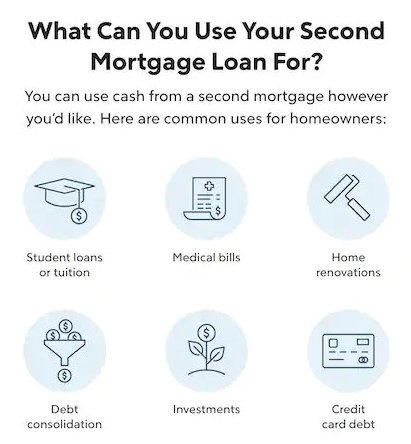

Borrowers can use a second mortgages to finance large purchases such as a new

vehicle, second home, down payment of an rental income investment property,

consolidate debt, pay for their child’s college education, renovate their home or who

just need cash.

How do I qualify for a Self Employed Heloc Second Mortgage?

To qualify, your income is calculated by adding up all the deposits in your business

and/or personal account for either a 12 or 24-month period, and then dividing the

total by the same number of months. This method is very effective because it allows

their income to be calculated based on gross deposits. It is important to note that the

final qualifying income for buisnesses deposits is less than direct personal deposits for

services rendered.

Is a Self Employed Heloc Second Mortgage the same as a Stand

Alone Second Mortgage

YES! Usually a Stand Alone Second are advertised using tax returns to qualify not

bank statement deposits. At 1st Florida Lending, we offer both Bank Statement

Deposit and (“full doc stand alone second mortgages”) using gross tax return and W2

income at a lower rate.

Self-Employed Second Mortgage Loans are popular with borrowers listed below

Qualifying for a Self-Employed Bank Statement Loan

Bank Statement Loans are utilized by a wide range of self-employed professionals, including

Business owners, Freelance employees, Consultants, Contract workers, Independent

contractors, Sole proprietors, Online retailers, Economy workers, Realtors, Entrepreneurs and

many other types of self-employed people, etc... Being self-employed it can be difficult to obtain

a mortgage. The facts are that most self-employed would agree that their tax returns don't really

show their true income as many tend to write off many expenses over that a W-2 wage earner.

Regardless of what you make for income, tax write-offs and deductions reduce your taxable

income that can affect your debt-to-income ratios. As a result, your net taxable income (after

deductions) may disqualify you for a traditional mortgage for purchasing and/or refinancing !

Q. How do we calculate income utilizing personal bank statements or business bank

statements?

•

Personal Bank Statement Loan: Income received for your goods and/or services is payable

to your personal name and deposited into your personal bank account.

•

Business Bank Statement Loan: Income received for your goods and/or services is payable

to your business name and deposited into your business bank account.

Determining Qualifying Income

•

We use total bank statement deposits to establish a monthly qualifying Income. Eligible

income is calculated differently between a personal bank statement and business bank

statement loan.

•

Personal Bank Statement Loan: We count 100% of your deposits which is utilized in

Analysis

•

Business Bank Statement Loan: : We count up to 85% of your deposits which is utilized in

Analysis

Borrowing Matrix

Eligible Borrowers

•

US Citizens

•

Permanent Resident Aliens

•

Non-Permanent Resident Aliens

o

Visa E/G/H/L/O/P/TN

•

Non-Occupant Co-Borrowers

Loan Amount

•

Minimum Loan Amount $200,000

•

Max Loan Amount $1,000,000

Ineligible Borrowers

•

Foreign Nationals

•

Irrevocable Trusts or Land Trusts

•

Diplomatic immunity

Qualifying Income Documentation

•

Full Doc - 1 Year Tax Returns

•

Stated - 12 months Bank Statements

Reserves

•

Cash out may be used for reserves

•

No Gifts of equity allowed

Eligible Property Types

•

Primary Home: No reductions

•

Second Home

•

Investment Property

•

2-4 Multi Family Unit

•

Condos: FNMA Warrantable

•

Non-Warrantable Condo ( case by case

only)

Ineligible Property Types

•

Condotels

•

Rural/Ag or Vacant Land

•

Unique(dome, berm,etc)

•

Condition C5 or C6

•

Manufactured/Mobile homes

•

Co-ops

•

Mixed-use

Appraisal Type

•

AMC Appraisal Only

- MORTGAGE GLOSSARY OF TERMS

- MORTGAGE CALCULATOR

- LOAN PROGRAMS

- USDA LOAN INFORMATION

- NON-QM MORTGAGE

- PRE-APPROVAL DOCUMENT-CHECKLIST

- APPRAISALS

- LEARN ABOUT CREDIT

- REPAIR YOUR CREDIT

- CLOSING COST

- REFINANCING YOUR LOAN

- MORTGAGE CREDIT EVENTS

- PMI-MORTGAGE INSURANCE

- FORECLOSURE INFORMATION

- NON-WARRANTABLE CONDOS

- THE LOAN PRE-APPROVAL PROCESS

- REQUEST RATE QUOTE

- FHA LOANS - NO DOWN PAYMENT

- BANK STATEMENT LOANS - 90% LTV

- JUMBO LOANS

- CONVENTIONAL LOANS

- PROGRESSIVE REPAYMENT MORTGAGE

- CONTRUCTION LOANS

- INVESTMENT PROPERTY LOANS - 85% LTV

- STATED MORTGAGE FOR PRIMARY -SECOND HOMES

- NO DOC FUNDING - 6 PROGRAMS

- FOREIGN NATIONAL LOANS

- ASSET BASED MORTGAGE LOAN

- FIX AND FLIP BRIDGE LOANS

- COMMERCIAL PROPERTY LOANS

- VOE MORTGAGE LOANS

- ITIN TAX ID LOAN

- USDA LOAN

- VA LOANS 100% LTV