Florida’s Best Direct Mortgage Lender

Perfect A+ Rating Score by the Better Business Bureau

Florida’s Top Rated Direct Mortgage Lender w/ 48 Loan Program

A+ BBB Rating I 4.8 Google Reviews

Call or Text us at 407-300-2558 I 800-655-1345

A FEW HIGHLIGHTS

560 FICO APPROVED FHA LOANS w/ 10%DP

48+ PROGRAMS with LOW RATES

A DIRECT LENDER - NOT RETAIL BROKER

WE LIKE CHALLENGING LOANS

SAME DAY LOAN PRE-APPROVAL LETTER

A TRUSTED LENDER FROM FL TO CA

CALL OR TEXT US AT 407-300-2558

CARLOS MATOS - CEO & FOUNDER

Trusted Direct Lender with Decades of Experience - Servicing Florida and California Primary Home Owners and Investor/Commercial Properties Nationwide

Including investor and commercial property financing in AL, AZ, CA,

GA, FL, IL, IA, KS, KY, LA, MN, MT, ND, OK, PA, SC, SD, TX, and WV

We offer Loans from Florida to California

for all Purchases, Refinancing and HELOC’s

© 2007 - 2023 1st Florida Lending Corp. - All rights reserved I Privacy Policy I Terms of Use I

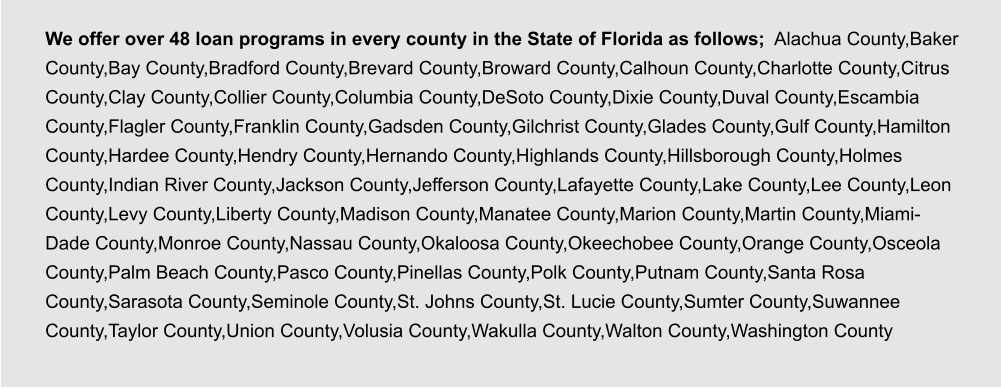

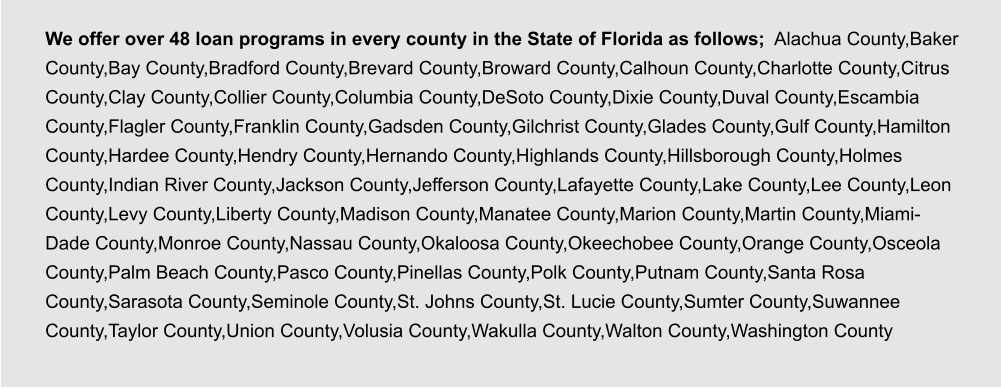

Hometown Heroes Down

Payment Assistance Program

for 2025 - Up to $35,000

Limited Funding Alert: The Hometown Heroes Program is funded annually and awarded first-

come, first-served. When funds run out, new reservations pause until the next funding cycle.

Apply early to secure your spot. The Florida Hometown Heroes Housing Program helps

eligible Florida workers become homeowners by offering down payment and closing cost

assistance on a primary residence. Along with assistance, qualified buyers may receive

reduced first-mortgage rates and other benefits, making homeownership more attainable in

the communities they serve. Click Here to download the 2025 Loan Limit Chart

The Florida Hometown Heroes Housing (HTH) Program makes homeownership affordable

for eligible workforce occupations. This program provides down payment and closing cost

assistance to first-time, income-qualified homebuyers so they can purchase a primary

residence in the community in which they work and serve. The Florida Hometown Heroes

Loan Program also offers a lower first mortgage interest rate and additional special benefits

to those who have served and continue to serve their country.

Eligible Borrowers

•

A person employed full-time by a Florida-based employer as a Healthcare professional,

Law enforcement, educators, school staff members, childcare employee first responders,

public safety employee, civil servant;

•

A servicemember of the United States military or military reserves, the United States Coast

Guard or its reserves, or the Florida National Guard; or

•

A veteran employed full-time by a Florida-based employer.

Those who meet the occupational requirements, work full time, and are currently employed by

a Florida-based employer can receive competitive market interest rates on an FHA, VA, RD,

and Conventional first mortgage, reduced upfront fees, no origination points or discount

points and down payment and closing cost assistance.

Key Benefits

•

Competitive first-mortgage rates with fixed terms.

•

Works with popular loan types: FHA, VA, USDA, and Conventional (HFA

Preferred/Advantage).

•

Borrowers can receive up to 5% of the total first mortgage loan amount (maximum of

$35,000/minimum of $10,000) in funds towards down payment and closing cost

assistance.

•

May be combined with select local grants and lender credits (program permitting).

•

No monthly payment on the assistance second (terms vary by year ask for current details).

Tips: Income and price limits, credit score minimums, and assistance caps change

periodically. Ask us for the current 2025 limits for your county or Click Here to download the

2025 Loan Limit Chart

How the Program Works

1.

Get pre-approved with 1st Florida Lending to confirm eligibility and budget.

2.

Reserve funds (we handle the reservation once you’re approved and under contract).

3.

Complete homebuyer education (if required) and provide documents.

4.

Close on your home with your first mortgage + deferred assistance second.

What You Can Buy

•

Single-family homes, town homes, condos, and select PUDs (primary residence only).

•

New construction or resale (condo/project approval may be required).

Documents to Get Started

•

Government ID and recent pay stubs (or verification of employment).

•

W-2s/1099s and tax returns (as applicable).

•

Bank statements for assets used toward closing and reserves.

•

Signed purchase contract (when available).

Frequently Asked Questions

Is funding really limited?

Yes. Each year’s allocation is finite and reserved on a first-come, first-served basis. When

funds are depleted, new reservations pause until the next cycle.

Do I have to be a first-time buyer?

•

Generally yes, with standard exceptions (e.g., certain veteran or targeted-area rules). We’ll

confirm based on your profile.

Can I combine Hometown Heroes with other assistance?

•

Often, yes subject to program rules, lien position, and total assistance caps.

Which loan types are allowed?

•

FHA, VA, USDA, and Conventional (HFA Preferred/Advantage), subject to program

guidelines.

Do you offer other Down Payment Assitance Programs other than this one?

•

Yes! Click to learn more .

There is no cost to apply for Hometown Heroes Down Payment Assistance.

Why Choose 1st Florida Lending?

As a Florida-based direct lender, 1st Florida Lending streamlines your approval, reserves

Hometown Heroes funds quickly, and coordinates everything through closing, so you don’t

miss out due to timing.

Ready to check your eligibility?

Click Request a Quote online for fast pre-approval or call 407-300-2558 to speak with a

specialist today. There is no cost to apply for Hometown Heroes Down Payment Assistance.

Hometown Heroes Down

Payment Assistance Program

for 2025 - Up to $35,000

- MORTGAGE GLOSSARY OF TERMS

- MORTGAGE CALCULATOR

- LOAN PROGRAMS

- USDA LOAN INFORMATION

- NON-QM MORTGAGE

- PRE-APPROVAL DOCUMENT-CHECKLIST

- APPRAISALS

- LEARN ABOUT CREDIT

- REPAIR YOUR CREDIT

- CLOSING COST

- REFINANCING YOUR LOAN

- MORTGAGE CREDIT EVENTS

- PMI-MORTGAGE INSURANCE

- FORECLOSURE INFORMATION

- NON-WARRANTABLE CONDOS

- THE LOAN PRE-APPROVAL PROCESS

- REQUEST RATE QUOTE

- FHA LOANS - NO DOWN PAYMENT

- DOWN PAYMENT ASSISTANCE

- SELF-EMPLOYED LOANS

- PROFIT AND LOSS LOAN

- CONVENTIONAL LOANS

- HELOC LOANS

- CONTRUCTION LOANS

- INVESTMENT PROPERTY LOANS - 85% LTV

- NO INCOME PRIMARY LOANS

- NO DOC FUNDING - 6 PROGRAMS

- FOREIGN NATIONAL LOANS

- ASSET BASED MORTGAGE LOAN

- FIX AND FLIP BRIDGE LOANS

- COMMERCIAL PROPERTY LOANS

- VOE MORTGAGE LOANS

- ITIN TAX ID LOAN

- USDA LOAN

- VA LOANS 100% LTV

- VACANT LAND LOANS